July 12, 2010 at 3:10 p.m.

Filed under:

M&A,

Media

By Los Angeles Times

Comcast Corp. and NBC Universal has reached an agreement with the Independent Film & Television Alliance over their proposed merger, which is being reviewed by the Federal Communications Commission and Justice Department.

The alliance reversed its opposition to the merger on the grounds it would stifle creativity in exchange for a promise that Comcast and NBC would allocate $6 million over four years to a development fund for independent productions.

July 12, 2010 at 2:39 p.m.

Filed under:

M&A,

Pharmaceuticals

By Dow Jones Newswires

Johnson & Johnson said Monday it plans to bolster its lineup of stroke-prevention products by buying Micrus Endovascular Corp. for about $480 million, marking the latest deal in a neurovascular-device market that appears to be heating up.

J&J’s planned purchase of San Jose, Calif.-based Micrus comes weeks after rival Covidien PLC announced plans to buy ev3 Corp. , a Micrus rival, for $2.6 billion. Leerink Swann analyst Rick Wise said the Covidien-ev3 combination may have spurred on J&J amid a trend of focusing more on bundled portfolios of products. Get the full story »

July 12, 2010 at 2:16 p.m.

Filed under:

Consulting,

Insurance,

M&A

Aon headquaters in Chicago. (AP)

By Bruce Japsen and Becky Yerak | After talking for a “reasonably long period of time,” Aon Corp. is taking over Hewitt Associates for $4.9 billion in cash and stock to expand its offerings to global employers navigating the complexities of health care reform and employee benefits.

The announcement Monday has pushed stock in the stock in the Chicago-based insurance brokerage and consulting firm down 7 percent in in late-afternoon trading. Get the full story »

July 12, 2010 at 12:13 p.m.

Filed under:

M&A,

Media

By Michael Oneal

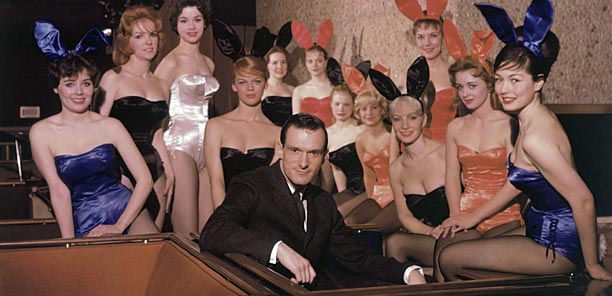

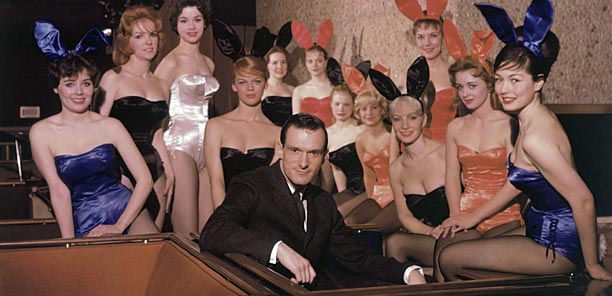

Hugh Hefner with a dozen Playboy Bunnies at the original Chicago Playboy Club in 1960. (Playboy)

Shares in Playboy Enterprises Inc. surged nearly 35 percent this morning after its board of directors said it received a proposal from Hugh Hefner to acquire all of the outstanding shares of the struggling media company for $5.50 per share in cash.

Hefner, 84, currently owns 69.5 percent of Playboy’s Class A common stock and 27.7 percent of its Class B common stock, and has teamed with a Michigan private equity firm called Rizvi Traverse Management LLC to fund the bid for the shares he doesn’t own.

The Hefner bid values Playboy at $185 million but could spark an auction for the company. Marc Bell, chief executive of FriendFinder Networks Inc., which owns the rival Penthouse adult franchise, said he is readying a competing bid for Playboy. Get the full story »

July 12, 2010 at 10:32 a.m.

Filed under:

M&A,

Retail

By Dow Jones Newswires

Beauty products direct-seller Avon Products Inc. said it will buy closely held sterling-silver jewelry seller Silpada Designs Inc. for at least $650 million.

An additional payment will be made to Silpada shareholders in early 2015 if certain earnings-growth targets are hit. There is no contractual minimum or maximum to this potential payment, but Avon estimated that it could range from $50 million to $100 million. Get the full story »

July 12, 2010 at 10:22 a.m.

Filed under:

Food,

Litigation,

M&A

By Reuters

Anheuser-Busch InBev, the world’s largest brewer, said Monday that a New York arbitration panel has ruled that its ownership of a 50 percent stake in Grupo Modelo is legitimate, dismissing the Mexican beermaker’s $2.5 billion claim.

Ending the dispute could open the way to AB InBev increasing its stake in Modelo, Mexico’s largest brewer and producer of the Corona brand, analysts say. Get the full story »

July 12, 2010 at 5:59 a.m.

Filed under:

Bankruptcy,

M&A,

Retail

By Reuters

Jones Lang LaSalle Inc. a real estate services company, said Monday it expanded its retail arm by acquiring third-party mall and shopping center leasing and management responsibilities from No. 2 U.S. mall owner General Growth Properties Inc.

Terms of the deal, which closed on Friday, were not disclosed. General Growth, which filed for bankruptcy protection in April 2009, will continue to manage and lease the nearly 200 malls it owns. Get the full story »

July 8, 2010 at 1:31 p.m.

Filed under:

Airplanes,

Computers,

Defense,

M&A,

Technology

By Associated Press

Boeing announced its second acquisition in as many weeks, saying it will buy anti-cyber attack software company Narus.

Narus will be a wholly owned subsidiary operating in the Network & Space Systems unit of Boeing’s defense business. Narus also will develop smart grid energy projects, as well as help protect Boeing’s in-house computer network, it said. Get the full story »

July 7, 2010 at 6:01 a.m.

Filed under:

Food,

International,

M&A

By Dow Jones Newswires

Kraft Foods Inc. reached a deal to sell Cadbury’s Romanian operations to investment fund Oryxa Capital for an undisclosed amount. The deal — involving the Kandia-Excelent chocolate, soft cake and sugar confectionery business — is the last sale required by European regulators as part of Kraft’s $19 billion purchase earlier this year of Cadbury. Get the full story »

July 6, 2010 at 6:41 a.m.

Filed under:

M&A

By Tribune staff report

Sara Lee has completed the sale of its Ambi Pur air freshener unit to Procter & Gamble Co. for $402 million. Ambi Pur has a presence in 80 countries, and also has several toilet care products, with strong presence in Western Europe and Asia.

“This divestiture will further enable Sara Lee to focus its efforts in areas where we have a strong competitive position and can generate shareholder value,” said Marcel Smits, interim chief exective of Sara Lee Corp.

July 2, 2010 at 11:32 a.m.

Filed under:

M&A,

Pharmaceuticals

From Bloomberg | Sources familiar with the situation say that French drugmaker Sanofi-Aventis SA is preparing a major acquisition in the U.S. Acquisitions allow big drugmakers to replenish their supply of newer drugs and cut costs by combining sales forces. One analyst believes that Sanofi may want to consider diversifying by buying Mead Johnson Nutrition Co., a maker of infant formula that was spun off from Bristol-Myers Squibb Co. last year. Other acquisition targets might include Mylan Inc., the biggest U.S. maker of generic drugs, and Hospira Inc.

July 1, 2010 at 5:32 p.m.

Filed under:

Airlines,

M&A,

Technology,

Travel

By Julie Johnsson

Google Inc. is poised to shake-up the online travel market with its $700-million acquisition of ITA Software Inc., whose search engine tools are used to power leading Web-based travel agencies like Chicago-based Orbitz Worldwide.

The all-cash deal announced Thursday would make Google a vendor to — and potential competitor of — many of the most prominent online travel sites, including Kayak.com, FareCompare.com, Hotwire Group and Microsoft Corp.’s Bing Travel.

The deal is almost certain to face tough scrutiny from federal antitrust officials, given Google’s conflicted role and its clout as a sprawling Internet giant. Get the full story »

July 1, 2010 at 9:05 a.m.

Filed under:

M&A,

Pharmaceuticals

By Alejandra Cancino

Javelin Pharmaceuticals Inc. said Thursday it accepted a tender offer by Hospira Inc. to buy about 79 percent of the company’s shares. Under the offer, which expired on Wednesday at midnight, Hospira will purchase about 51.3 million shares at $2.20 per share. Javelin said the merger is expected to be completed by Friday. Get the full story »

July 1, 2010 at 5:58 a.m.

Filed under:

Food,

M&A

By Reuters

Britain’s Tate & Lyle, which has several facilities in Illinois, is selling its European sugar operations to American Sugar Refining for 211 million pounds, breaking a 150-year link to sugar in favour of low-calorie sweeteners offering faster growth. The privately-owned U.S. group is buying Tate’s sugar and Golden Syrup business with a perpetual licence to use the Tate & Lyle name, while Tate said on Thursday it will focus on its sweeteners such as Splenda and its industrial starches. Get the full story »

June 30, 2010 at 2:10 p.m.

Filed under:

Insurance,

M&A

By Tribune staff report

Unitrin Inc. has bought the Kemper name from Lumbermens Mutual Casualty Co. Terms were not disclosed.

Since 2002, Chicago-based Unitrin, an insurance holding company, has owned the personal lines property and casualty insurance business of Lumbermens. It operated the personal lines with the Kemper name under a licensing agreement. Get the full story »