Aug. 30, 2010 at 1:10 p.m.

Filed under:

Banking,

Economy,

Government,

Regulations

By Dow Jones Newswires

A senior Federal Reserve policymaker said Monday it may be impossible to test new measures to limit systemic risk in the banking system before the next financial crisis.

St. Louis Fed President James Bullard said the credibility of too-big-to-fail elements in the sweeping financial reform bill rested on them being tested in practice. Get the full story »

Aug. 27, 2010 at 4:21 p.m.

Filed under:

Bank failures,

Banking,

Economy,

Investing,

Policy

By Reuters

A U.S. appeals court granted the Federal Reserve a 60-day delay in implementing a ruling to force the central bank to reveal details of its emergency lending programs to banks during the financial crisis. Get the full story »

Aug. 27, 2010 at 1:31 p.m.

Filed under:

Economy

By Associated Press

(AP)

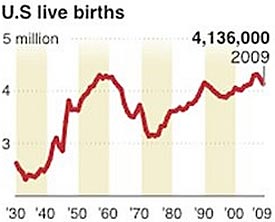

The U.S. birth rate has dropped for the second year in a row, and experts think the wrenching recession led many people to put off having children. The 2009 birth rate also set a record: lowest in a century.

Births fell 2.6 percent last year even as the population grew, numbers released Friday by the National Center for Health Statistics show.

Aug. 27, 2010 at 9:32 a.m.

Filed under:

Economy,

Policy,

Politics

By Associated Press

Federal Reserve Chairman Ben Bernanke said Friday that the Fed will consider making another large-scale purchase of securities if the slowing economy were to deteriorate significantly and signs of deflation were to flare.

Aug. 27, 2010 at 7:44 a.m.

Filed under:

Economy,

Trade

By Reuters

U.S. economic growth slowed more sharply than initially thought in the second quarter, held back by the largest increase in imports in 26 years, a government report showed on Friday. Gross domestic product expanded at a 1.6 percent annual rate, the Commerce Department said, instead of the 2.4 percent pace it had estimated last month. Get the full story »

Aug. 26, 2010 at 3:53 p.m.

Filed under:

Economy,

Investing,

Stock activity

By Associated Press

Stocks ended lower Thursday after early gains from a better report on jobless claims faded. The Dow Jones industrial average closed below 10,000 for the first time since early July. The Dow lost 74 points, having been up as much as 45 earlier. The back-and-forth trading pattern has been common in recent weeks as many investors remain unconvinced that the economic recovery will hold.

Aug. 26, 2010 at 9:40 a.m.

Filed under:

Economy,

Housing,

Mortgages,

Real estate

By Reuters

A home for sale in Kildeer, Ill. (Scott Olson/Getty Images)

U.S. mortgage rates fell in the latest week to the lowest on record and posted their ninth drop in the last ten weeks, Freddie Mac said on Thursday. Get the full story »

Aug. 26, 2010 at 7:37 a.m.

Filed under:

Economy,

Jobs/employment,

Layoffs

By Associated Press

New requests for unemployment benefits fell sharply last week after rising in the past three weeks. Still, claims remain much higher than they would be in a healthy economy.

The Labor Department says new claims for jobless aid dropped by 31,000 to a seasonally adjusted 473,000. Wall Street economists had expected a smaller drop, according to surveys by Thomson Reuters. Get the full story »

Aug. 26, 2010 at 7:35 a.m.

Filed under:

Economy,

Housing,

Real estate

By CNN

AGreyson Properties employee walks in front of a Western Springs home his company built. (Antonio Perez/Chicago Tribune)

Toll the bell for the McMansion. After years of growth, the Census Bureau recently reported that median new home size fell to 2,135 square feet in 2009 after peaking at more than 2,300 earlier in the decade.

“Home buyers are asking for less, cutting back on options and reducing square footage,“ said Steven Pace of the North Carolina-based Pace Development Group, which builds both custom and tract houses ranging in price from below $250,000 to more than $2 million. Get the full story »

Aug. 25, 2010 at 12:44 p.m.

Filed under:

Economy,

Investing,

Jobs/employment,

Politics,

Taxes

By Reuters

The Spectrem Millionaire Investor Confidence Index fell to its lowest level in more than a year in August as wealthy U.S. investors worried about politics and unemployment, according to Spectrem Group.

The index fell 11 points in August to -18, its lowest level since June 2009, when it fell a record 18 points to -20 shortly after the S&P 500 index hit a 12-year low. Get the full story »

Aug. 24, 2010 at 3:18 p.m.

Filed under:

Economy,

Policy,

Updated

By Dow Jones Newswires

Federal Reserve Bank of Chicago President Charles Evans said Tuesday the economic recovery is “extremely modest” but he believes it’s unlikely the economy will fall into a double-dip recession. Get the full story »

Aug. 24, 2010 at 8:07 a.m.

Filed under:

Economy,

Politics

By Reuters

U.S. House Republican leader John Boehner Tuesday called for the resignation of President Barack Obama’s economic team, including Treasury Secretary Timothy Geithner and White House economic adviser Larry Summers. Boehner, in the text of a speech to be given in Cleveland, called for a “fresh start” on the economy. Get the full story »

Aug. 23, 2010 at 10:26 a.m.

Filed under:

Bank failures,

Banking,

Economy,

Policy,

Politics

By Reuters

The viability of community banks is threatened by policies that have conferred “too big to fail” status on larger banks, reducing their cost of capital, Kansas City Federal Reserve Bank President Thomas Hoenig said on Monday.

Hoenig, in prepared testimony to a field hearing of the U.S. House of Representatives Subcommittee on Oversight and Investigations here, said the community bank model was still viable, especially if allowed to compete on an equal footing with larger banks. Get the full story »

Aug. 20, 2010 at 4:18 p.m.

Filed under:

Economy,

Investing

By Associated Press

Most commodities prices have closed lower as traders worry that global demand for raw materials will drop because of the slowing economy. Metals and energy prices are down while grains have closed mixed. Get the full story »

Aug. 20, 2010 at 2:27 p.m.

Filed under:

Bank failures,

Banking,

Economy,

Government

By Becky Yerak

The group seeking to buy ShoreBank, the ailing South Side lender expected to be seized by federal regulators Friday, plans to name former First Chicago executive Bill Farrow as the chief executive and president of the institution if it succeeds at bidding for certain assets and deposits of the failing bank.

It means that three former First Chicago executives will be running the show if their bid succeeds. Get the full story »